APAC Predicted to be a Dominant Driver in Global Infrastructure Investment

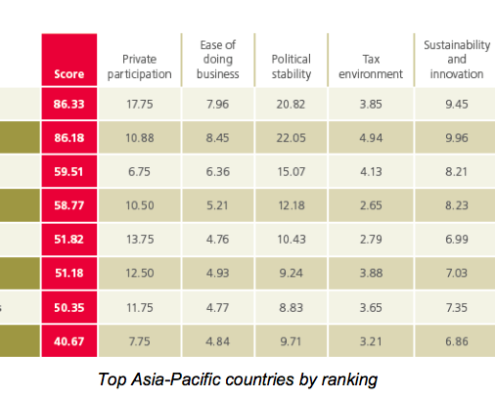

Australia, Singapore and China are driving momentum and interest for infrastructure investment in the Asia-Pacific, according to the CMS Infrastructure Index: A New Direction, which ranks 40 jurisdictions in order of infrastructure investment attractiveness according to six key criteria. Four of the top 20 spots for investment attractiveness were secured by Asia Pacific countries in the report, with robust economic growth across the region, ambitious renewables plans, and the world’s largest infrastructure project – China’s Belt & Road – set to reshape the continent’s landscape over the next decade.

Australia, Singapore and China are driving momentum and interest for infrastructure investment in the Asia-Pacific, according to the CMS Infrastructure Index: A New Direction, which ranks 40 jurisdictions in order of infrastructure investment attractiveness according to six key criteria. Four of the top 20 spots for investment attractiveness were secured by Asia Pacific countries in the report, with robust economic growth across the region, ambitious renewables plans, and the world’s largest infrastructure project – China’s Belt & Road – set to reshape the continent’s landscape over the next decade.

The Netherlands claimed top spot overall, despite a prolonged period with no government at all, after seeing the highest GDP growth since 2007, expected to reach 3.3 percent in 2017. The country’s success was in part down to its transparent and efficient procurement process, and its healthy multi-billion euro pipeline in road and water Public-Private-Partnerships (PPPs). Other countries in the top five included Canada, Germany, UK and Australia

CMS partner and Co-head of Infrastructure & Project Finance in the UK, Kristy Duane, commented, “From China’s Belt and Road to the UK’s Brexit bump in the road, politics and policy remain central to shaping infrastructure investment flows globally. If governments are to attract the apparent wave of private capital available, they should look to countries like the Netherlands and Canada for inspiration where transparency and a clear strategic vision for infrastructure shapes the agenda.

“The CMS Infrastructure Index charts interesting shifts in the attractiveness of 40 countries across the globe and also highlights changes occurring in the infrastructure asset class bringing a new wave of innovation to a market long dependent on standardised PPPs for much of its deal flow. The quest for deals has already prompted the industry to explore less mature sectors such as energy storage, broadband, smart meters, as well as student accommodation and rolling stock. It is fascinating to see which countries are leading the way.”

Click HERE to read the report’s findings in full.