Reading Time: 4 minutesOne innovative policy with widest coverage and most comprehensive solutions

Construction companies in Singapore seeking to protect their mobile plant and equipment have for the first time access to a single insurance package offering bespoke protection to meet their specific needs, following the launch of an innovative insurance solution by QBE Insurance (International) Limited – Singapore Branch.

QBE executives launch the new Industrial Special Plant insurance package in Singapore.

From left to right: James Yong, General Manager – Distribution, QBE Singapore; Karl Hamann, Chief Executive Officer, QBE Singapore; Kevin Guerin, Manager, Underwriting Agencies of Australia, and Mark Maytom, Technical Manager, Underwriting Agencies of Australia.

By providing the insured with more convenience, greater coverage and better leverage for the premium paid, QBE’s novel insurance package Industrial Special Plant (‘ISP’) reflects QBE Asia Pacific’s strategy to introduce solutions that better serve customer needs. ISP is a policy which can replace up to five standalone policies for policyholders, reducing both intermediaries’ and clients’ administrative costs. No other insurer offers such a comprehensive package in Singapore.

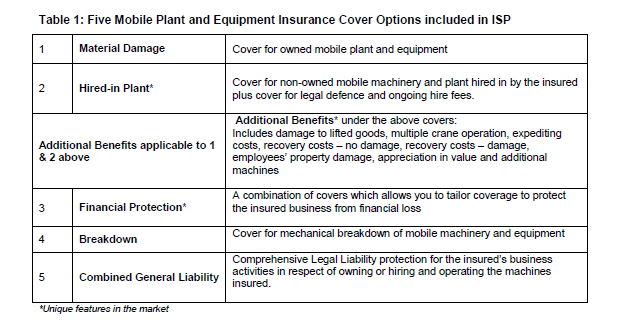

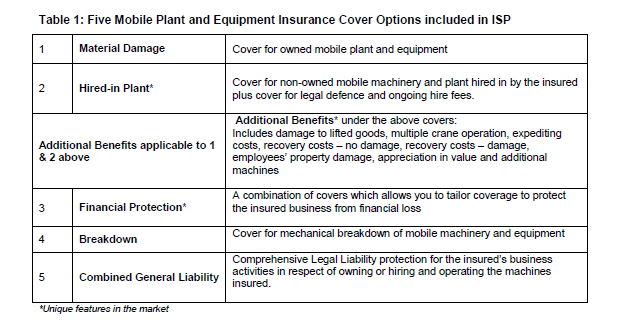

ISP offers five key options (see table 1), three of which are completely unique and new to Singapore. The options relating to ‘Hired-in Plant’ with ‘Additional Benefits’ such as ‘Employees’ Property Damage’ and ‘Financial Protection’, are all features of ISP previously unavailable in the Singapore market’s standard machinery all risk policies.

Another unique and important feature of ISP is that it provides clear-cut savings simply by having one deductible for one policy that offers multiple coverage, instead of far more costly multiple deductibles with multiple policies which to date have characterised the market in Singapore.

“ISP isn’t comparable to the existing insurance options in Singapore,” said Karl Hamann, Chief Executive Officer, QBE Singapore. “It provides construction companies with a comprehensive solution and the widest coverage at one go, reducing their administrative work from application to claims processes. It also offers a means to leverage the premium spend and negotiate better terms.”

ISP is the first and only policy in Singapore that provides such extensive covers for construction companies, machine owners or hirers with a comprehensive solution, considering all the risks associated in owning, operating or hiring these machines.

Until now, intermediaries in Singapore have typically had to purchase individual insurance policies, sometimes from different insurers, to provide a complete insurance solution for the insured. This presents significant risks to the intermediaries and the insured, because gaps in coverage may go unnoticed leading to claims disputes between different insurers causing delays in settlement, increased workload and greater cost.

“The complicated approach that has existed to date creates delays in settlement which ultimately cost companies money from disruption,” added Karl. “The comprehensive insurance package ISP provides is to reduce the risk of errors and omissions or claims disputes. It ultimately serves the companies’ needs more effectively by offering flexible choices of insurance.”

In Singapore, insurers offering contractors plant and equipment insurance base their premium usually on the ‘new replacement value’ of the equipment regardless of its actual value. Yet, if the machine is destroyed (declared a ‘total loss’) in an event, the insurer only pays its ‘actual value’ prior to the loss and not the ‘new replacement value’. So the policyholder doesn’t actually get the cover for which it paid a premium.

“ISP clearly makes better financial sense. It allows the policyholder to insure the machine for its current market value and, in the event of the machine being destroyed, ISP pays the current market value,” said Karl. “QBE is the only insurer in the market that allows the ‘market value’ as sum insured in the standard policy.”

“The Government will commit a further S$450 million over three years to raise productivity in the construction sector. This adds to a previous S$335 million in funding for the same purpose, set aside in the last five years. With this increase in the government spending to promote mechanisation and improve productivity in the industry, we anticipate that there will also be a surge in the demand for construction insurance coverage. The ISP solution that we have just introduced is poised to cater for the surging demand,” added Karl.

ISP was developed over the past 40 years as a specialty insurance product by Underwriting Agencies of Australia (UAA), where it was very well received in the marketplace. UAA are experts in mobile plant and machinery insurance.

QBE launches its ISP product in Singapore following its launch in Hong Kong last year because both cities are Asia’s leading financial hubs with massive construction activities in both countries where there are significant growth potential for the products. ISP is offered to any business that owns or operates mobile plant and machinery from small proprietors to large multinational corporations.

QBE executives launch the new Industrial Special Plant insurance package in Singapore.

From left to right: James Yong, General Manager – Distribution, QBE Singapore; Karl Hamann, Chief Executive Officer, QBE Singapore; Kevin Guerin, Manager, Underwriting Agencies of Australia, and Mark Maytom, Technical Manager, Underwriting Agencies of Australia.