Singapore, with its stable political situation, secure business environment and strong growth potential, remains the most attractive market for infrastructure investors, according to Arcadis, a global design and consultancy firm.

Singapore, with its stable political situation, secure business environment and strong growth potential, remains the most attractive market for infrastructure investors, according to Arcadis, a global design and consultancy firm.

Singapore has retained its position as the world’s most attractive market for the third edition of the Global Infrastructure Investment Index. The report highlights the most dynamic and attractive markets for infrastructure investment worldwide.

Singapore ranked consistently highly across business, risk, infrastructure and financial indicators, and despite a slightly lower score for economic factors, it maintains a strong overall economic environment. Whilst most projects have traditionally been publicly funded, Singapore is seeking to develop involvement from private institutional investors. Work is underway in the city-state to improve understanding of infrastructure as an asset class to make it more attractive to investors, part of which includes the development of new benchmarking tools.

Currently, Singapore invests around 5 percent of its GDP on infrastructure, equivalent to US$20 billion in 2015, and this continues to rise. By 2020, Singapore aims to invest 6 percent of GDP, the equivalent of US$30 billion, which makes the market even more attractive for investment. Priority schemes are planned in healthcare and transport, including the expansion of Changi Airport through the construction of a fifth terminal. Previous expansion of the airport, which involved construction of Terminal 4, saw Arcadis acting as lead surveyor.

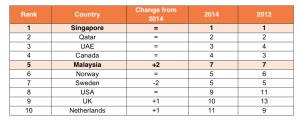

Elsewhere in Asia, Malaysia rose in the ranking to fifth place. Its strong economic performance and continued long-term investment in infrastructure, such as the capital’s metro system, have made the market attractive for investment. However, in the short term, investment is threatened by a number of risks, including its currency depreciation against the dollar and a high-profile corruption scandal that has delayed some projects.

In terms of economic score, China ranks first among the 41 countries analysed, yet its less attractive business conditions and higher risk environment keep it ranked at number 17 in the index.

The top ten most attractive countries for long-term infrastructure investment in 2016 are:

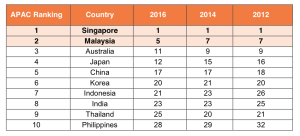

The rankings for Asia Pacific countries are:

Graham Kean, Head of Client Development at Arcadis Asia, said: “The index gives us valuable insights into how long-term political and economic stability leads to greater investment, so it is no surprise that Singapore remains at the top of the table. In the region as a whole, there is clearly a lot of social and public need for new infrastructure. There are a whole host of project ideas and plans out there, but they are not investible or bankable enough, which is the basic problem. The key to unlocking investments in the region hinges on making the projects bankable, an area which we have been supporting.”

Kean added, “We have already seen Asia-based investors taking positions globally as infrastructure becomes an increasingly popular asset class for private sector investors, particularly in times of increased risk and uncertainty. Income streams are relatively more stable and will be around for 30 years or more, the sort of timeframe some investors are increasingly drawn to. Short-term impacts can also create investment opportunities, such as a change of government or currency devaluation and these need to be weighed with the underpinning long-term situation.”