Reading Time: 5 minutesAsia’s future infrastructure is facing increasing scrutiny in terms of its sustainability, constructability, bankability, and resilience. A range of factors, not only the engineering design process, require attention if the region is to meet its ambitions of future-proofing tomorrow’s projects, say Aurecon’s Chief Executive, Asia, Stephane Asselin and Principal, Infrastructure Advisory, Jasmin Abad Lock.

Although infrastructure markets and policies are shifting, the Asia and Pacific region remains one of the largest in the world, with some US$900 billion spent each year. However, according to the Asian Development Bank, this figure falls short of the US$1.7 trillion that the region should spend to keep pace with climate change and economic growth.

National governments have recognised this and have already put in place necessary policies, public funds and other measures to increase private sector participation, including openly inviting international partners to support their infrastructure development ambitions.

Despite setbacks caused by COVID-19 and some slowing of programs, many Asian countries are still pressing on to build up their infrastructure. These countries are keen to keep up with development trends; of which there is stronger public support and increased appropriations for public infrastructure spending.

There is also a shift across private stakeholders in the form of transitioning investments from purely real estate-oriented (commercial mixed-use developments) to infrastructure-oriented developments. There is favour for larger government-backed and international community supported projects such as mass transport networks, bridges, clean energy, and water treatment systems. While there is interest in Public Private Partnerships, there is also a growing interest in the private sector and private equity-led development infrastructures like renewable energy plants, waste-to-energy facilities, smart city (district) systems, or green data centres across Southeast Asia.

Overall, we are seeing increased market potential, new technologies, better accessibility to finance and a changing mindset. Everyone now has a role to play in terms of getting it right when designing future infrastructure.

Climate change and net zero prompting change

Climate change is influencing the type and quality of infrastructure being built and operated now. It is also prompting consideration in relation to its immediate and future impact. As such, we have observed major shifts in infrastructure investments of interest.

The realisation of an impending climate emergency with a global movement to address this crisis gathering pace means some infrastructure will be rendered either stranded or obsolete. Future projects increasingly must be green, renewable, circular, sustainable, and low/zero carbon. Making infrastructure environmentally responsible and resilient is not only a major goal but a global journey. For example, there is a keen focus on renewable energy, floating solar, battery storage projects now as these projects present opportunities to supplement energy-intensive uses. Mass transit systems, too, are also exploring using energy from waste. While we are moving in this direction, there is still a long way to go to being fully reliant on renewable energy.

Asia is entering a phase where there are multiple opportunities to not only build infrastructure but to design higher quality and better infrastructure that not only addresses capacity issues, but offers concrete social, economic, and environmental benefits. Given the times, these projects must tick the box not just at the delivery stage but also during the operations and maintenance phases.

As a result, the role of engineering and advisory companies like Aurecon is becoming increasingly important. Clients and investors want to be ensured that the physical integrity of an infrastructure’s design, its impact, its financing, its overall lifecycle and operability, and in some cases even its disposal and reuse, have all been thought through comprehensively and creatively.

Although infrastructure investments in Asia are attractive, there is pressure for higher standards and better outcomes. Investments will favour specific projects that match the values of local as well as international communities. Infrastructure projects like power, water, transportation, smart and IT cloud-based developments remain attractive – presenting high benefits and returns. There is immense interest in new sources of clean and renewable energy, as well as in resilient infrastructure. Countries in Asia have policies and are exploring instruments to promote investments and financing in this space. This includes Hong Kong, Indonesia, the Philippines, Thailand, Singapore, and Vietnam.

Ushering in a new era for Asian infrastructure

We are entering an exciting new era of infrastructure development in Asia, and the good news is there is no shortage of funds to support these programs. However, lenders are demanding more of infrastructure investments and putting weight on non-financial requirements.

For example, there is increasing emphasis on addressing ESG (Environmental, Social, and Corporate Governance) as well as climate change-related disclosures. There are also new green financing windows opening like the World Bank’s City Climate Finance Gap Fund. This is a financing program that aims to unlock over EUR4 billion of investment in new infrastructure on the condition that it focuses on climate-smart projects and the urban climate initiative.

We must recognise that designing Asia’s infrastructure of tomorrow is an evolving and maturing process.

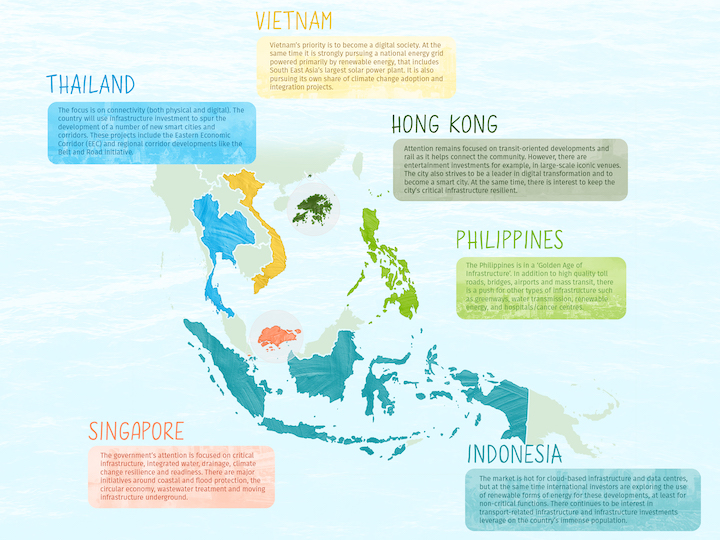

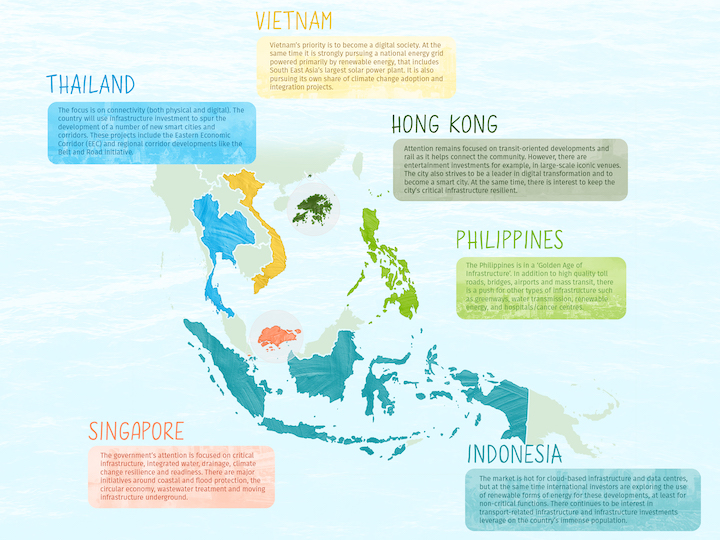

As much as Asia is attractive and unique in terms of its scale and required capacity for development, there are also higher expectations of design, quality, lifecycle, bankability, and operability that matter more now with increasing demands from investors and stakeholders. As engineers, we need to be open to new ways of doing things and remain agile. Every country has its own priorities, which investors must pay heed to, and it is interesting to note how this varies:

- [Hong Kong] Attention remains focused on transit-oriented developments and rail as it helps connect the community. However, there are entertainment investments for example, in large-scale iconic venues. The city also strives to be a leader in digital transformation and to become a smart city. At the same time, there is interest to keep the city’s critical infrastructure resilient.

- [Indonesia] The market is hot for cloud-based infrastructure and data centres, but at the same time, international investors are exploring the use of renewable forms of energy for these developments, at least for non-critical functions. There continues to be an interest in transport-related infrastructure and infrastructure investments leverage on the country’s immense population.

- [Philippines] The Philippines is in a ‘Golden Age of Infrastructure’. In addition to high-quality toll roads, bridges, airports and mass transit, there is a push for other types of infrastructure such as greenways, water transmission, renewable energy, and hospitals/cancer centres.

- [Singapore] The government’s attention is focused on critical infrastructure, integrated water, drainage, climate change resilience and readiness. There are major initiatives around coastal and flood protection, the circular economy, wastewater treatment and moving infrastructure underground.

- [Thailand] The focus is on connectivity (both physical and digital). The country will use infrastructure investment to spur the development of a number of new smart cities and corridors. These projects include the Eastern Economic Corridor (EEC) and regional corridor developments like the Belt and Road initiative.

- [Vietnam] Vietnam’s priority is to become a digital society. At the same time, it is strongly pursuing a national energy grid powered primarily by renewable energy, which includes South East Asia’s largest solar power plant. It is also pursuing its own share of climate change adoption and integration projects.

Embracing digital engineering to design resilient infrastructure

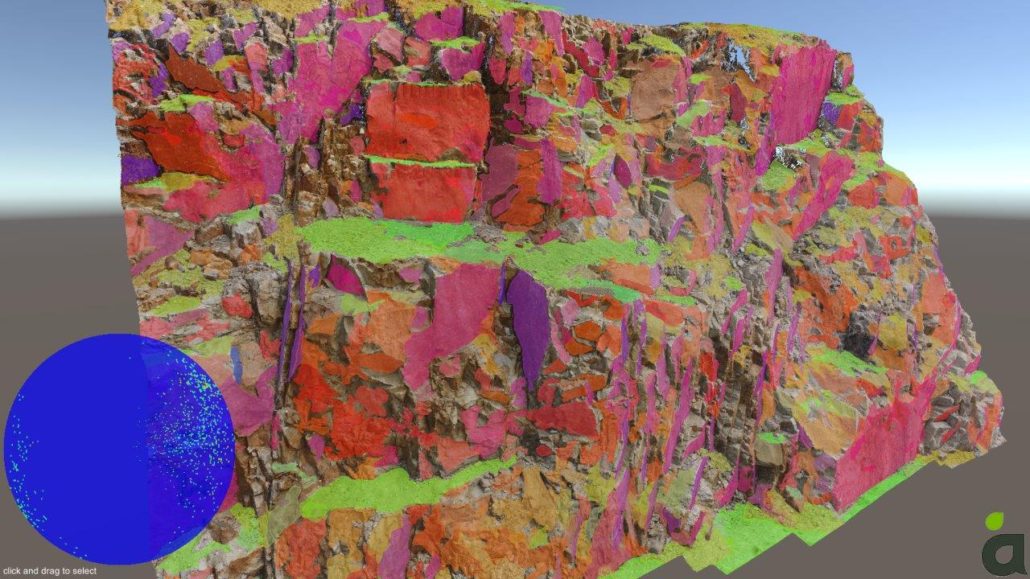

Delivering and commissioning such a varied group of projects makes design thinking critical. A big part of the upcoming solutions will leverage digital engineering. To plan for the impacts of climate change on infrastructure, we must consider an increasingly wide range of scenario planning. And the only practical way to run the complex calculations that are needed to simulate the performance of infrastructure in limitless scenarios is through digital engineering and modelling.

Investors also now want to see the long-term cost, operability, and security of their asset investments either through management or monitoring systems or digital twins. A great way to demonstrate this is via digital engineering, or a “model first” approach that provides instant visualisation to the audience. Digital engineering can show owners and governments how to better design, as well as manage and monitor the infrastructure asset once it is built and will open the door to further possibilities like operational efficiencies down the line. Although digital engineering remains a relatively new concept in construction, it is exciting to consider the potential it offers.

Smart infrastructure will determine Asia’s ability to withstand climate change and drive emissions reductions and a greener way of living. By focusing on good design and getting smart about technology, we have the power to shape a bright new future. And one that ensures we remain an attractive investment opportunity for the whole world.