Reading Time: 3 minutes

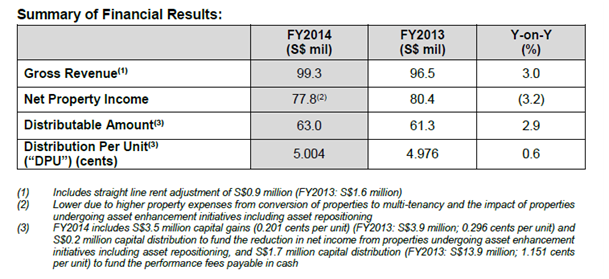

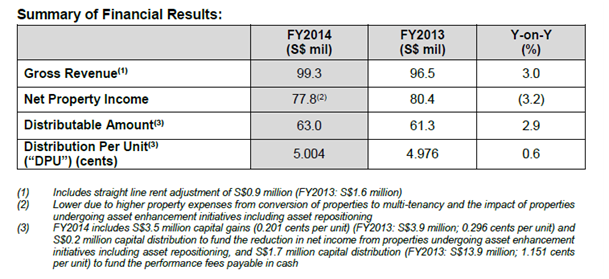

Singapore – Cambridge Industrial Trust Management Limited (“CITM”), the Manager (“Manager”) of Cambridge Industrial Trust (“CIT”), has announced a distribution per unit (“DPU”) of 5.004 cents for its financial year ended 31 December 2014 (“FY2014”), up 0.6% from 4.976 cents in the same period a year ago.

During the year, gross revenue increased 3.0% to S$99.3 million, while net property income (“NPI”) declined 3.2% to S$77.8 million as a result of higher property expenses due to the conversion from single-tenancy to multi-tenancy. We have converted four single-tenanted properties to multi-tenanted properties (“MTBs”) with another two to come in 2015. This brings the total number of converted MTBs to 19.

In addition, as part of CIT’s strategy, a number of value-add properties were acquired. They will contribute to rental revenue once fully leased. FY2014 distribution of S$63.0 million was 2.9% higher than FY2013 (S$61.3 million).

Commenting on the results, Mr Philip Levinson, CEO of CITM, remarked, “This quarter we achieved a significant milestone in the acquisition of our 50th property, which was also our maiden business park asset investment. We took advantage of the low interest rate environment to reduce the cost of our debt through a well subscribed S$100 million MTN issue.”

“We will continue to explore value-creating acquisition opportunities, proactively manage our high quality Singapore portfolio and deliver value through ongoing asset enhancement initiatives, whilst maintaining a disciplined financial and capital management approach. CIT has a strong platform, supported by a high calibre team, which positions us well to achieve sustainable growth and value for our Unitholders into the future.”

Proactive Capital and Interest Rate Management

As at 31 December 2014, CIT’s total debt was S$480.0 million with a weighted average debt expiry of 2.2 years and an all-in cost of debt of 3.68%. In line with the Manager’s prudent capital and risk management strategy, approximately 90.0% of total debt has been fixed for the next two years, and CIT remains well positioned with S$407.5 million in unencumbered assets, S$90.0 million in available committed facilities and a gearing ratio of 34.8%.

Diversified and Quality Portfolio

On 19 December 2014, CIT completed the acquisition of its maiden business park, 16 International Business Park at a purchase consideration of S$28.0 million. This 3-storey purposed-built building with a mezzanine floor and a basement carpark has a GFA of approximately 69,258 sq ft and is leased to M+W Singapore Pte Ltd for 11.6 years With the completion of 16 International Business Park, CIT has 50 properties located in Singapore. As at 31 December 2014, CIT’s properties are leased to a diversified base of 168 tenants with total gross floor area of approximately 8.4 million sq ft.

The Manager continues to proactively manage the properties through asset enhancement initiatives (“AEI”). On 10 December 2014, CIT completed the Phase II AEI works for 21B Senoko Loop which involved the construction of a 4-level warehouse with a basement and a detached single-tenanted factory building. This AEI brings an additional GFA of approximately 73,026 sq ft. The property is currently undergoing Phase I AEI works which involve the upgrading of the cargo-lift and is targeted to complete in 1Q2015. Upon the completion of Phase I, the property will have a total GFA of approximately 196,872 sq ft.

As at 31 December 2014, CIT’s portfolio was valued at S$1.37 billion by independent valuers, Colliers International and Knight Frank Pte Ltd. Net Asset Value per unit for FY2014 stood at 68.1 cents.