Clean and Renewable Energy

Solar Photovoltaic (PV) is perhaps the first thing that comes to people’s minds on the subject of clean renewable energy. PV technologies convert energy from sunlight into direct current (DC) electricity. They provide an ideal sustainable energy solution for remote rural areas, where it is neither technically feasible nor economically viable to extend grid coverage to isolated areas. However, in developed urban cities, it is common to find PV systems installed in buildings and on rooftops as well.

Globally, PV demand has been on an upward trend. Especially in recent years, the demand accelerated as the price of the commonly-used PV material – crystalline silicon – took a plunge from $4/watt in 2008 to $2/watt in 2010. Today, it even costs less than $1/watt, and observers foresee that the prices will fall further. The sharp drop in prices is largely due to innovations in PV technologies and manufacturing automation. This price movement stands in contrast with the rising cost of electricity as fuels are being depleted.

The growing preference for choosing sustainable solutions has also egged on the PV market. This is due to a combination of reasons such as the on-going global struggle to reduce carbon emissions, government incentives, schemes to encourage green building, and higher capital value for buildings with green certification.

An Overview of PV Technology

In general, PV materials are mainly categorized as crystalline silicon(c-Si) or thin film. They are judged on two basic factors – efficiency and economics – to determine which application is best. These materials are further subdivided into different categories which provide different efficiencies.

Crystalline silicon (c-Si)

Monocrystalline silicon Panel

Multicrystalline silicon Panel

For remote installations where the space available for PV panels is often quite limited, the greater conversion efficiency of c-Si technology has the advantage. C-Si modules represent 85-90% of the global annual market today.

C-Si modules are subdivided into two main categories: single crystalline silicon (Sc-Si) and multi-crystalline silicon (mc-Si). Sc-Si panels should be used when a higher voltage is desirable. This would be when the DC power has to travel some distance before being utilized or stored in a battery bank. These panels are also the most efficient in PV technology, averaging 14% to 17% efficiency. In comparison, mc-Si panels have efficiencies of 12% to 14% but they can often be purchased at a lower cost per watt than sc-Si panels.

Thin film technology

While thin film panels are cheaper than c-Si panels, it is worth noting that the conversion efficiency of thin-film panels is lower and tends to drop off rather rapidly in the first few years of operation.

Thin films are subdivided into three main families: amorphous (a-Si), Cadmium-Telluride (CdTe), and Copper-Indium-Gallium-Selenide (CIS/CIGS). Depending on the technology, thin-film module prototypes have reached efficiencies of between 7–13% and production modules operate at about 9%. Performance deterioration must be taken into account when assessing the array for a multi-year project. However, there are still applications where the lighter weight and greater flexibility of the thin-film panels may be more suitable. Thin films currently account for 10% to 15% of global PV module sales.

Types of PV Systems

There are different types of systems in which the PV modules are integrated. Solar PV systems are mainly divided into grid-connected / grid-tie systems and off-grid / stand-alone systems.

For grid-connected systems, the PV system operates in parallel with the public electricity network. In general, most of the PV systems installed in developed countries are grid-connected.

If connection to the grid is not possible, or if there are no electricity mains, then the PV systems are installed as stand-alone systems.

Thin film technology

While thin film panels are cheaper than c-Si panels, it is worth noting that the conversion efficiency of thin-film panels is lower and tends to drop off rather rapidly in the first few years of operation.

Thin films are subdivided into three main families: amorphous (a-Si), Cadmium-Telluride (CdTe), and Copper-Indium-Gallium-Selenide (CIS/CIGS). Depending on the technology, thin-film module prototypes have reached efficiencies of between 7–13% and production modules operate at about 9%. Performance deterioration must be taken into account when assessing the array for a multi-year project. However, there are still applications where the lighter weight and greater flexibility of the thin-film panels may be more suitable. Thin films currently account for 10% to 15% of global PV module sales.

Building Integrated Photovoltaics (BIPV) System

Building Integrated Photovoltaics (BIPV) is the integration of PV into the building envelope (eg. windows, walls, or roof tiles etc). It allows for seamless integration into a building’s design. BIPV products work particularly well for new building construction or a significant remodeling. The PV modules serve the dual function of being the building skin – replacing conventional building envelope materials – and power generator.

BIPV systems should be adopted where there is energy-conscious design, and where equipment and systems have been carefully selected and specified. They should be viewed in terms of life-cycle cost, and not just initial, first-cost. The overall cost may be reduced by the displacement of inefficient building materials and labor. Design considerations for BIPV systems must include the building’s use, its electrical loads, its location and orientation, the appropriate building and safety codes, and the relevant utility issues and costs. However, as BIPV panels are made for both photovoltaic and thermal collection systems, designers often place both technologies side-by-side to further maximize efficiencies.

Evolution of PV Demands

According to a report[1] “A Snapshot of Global PV 1992-2013” by International Energy Agency (IEA), preliminary market data shows that there is a growing market in 2013, for the first time in two years. At least 36.9 GW of PV systems have been installed and connected to the grid in the world last year. While these data will have to be confirmed in the coming months, some important trends can already be discerned:

- The global PV market grew to at least 36.9 GW in 2013, compared to around 29 GW in the last two years.

- Asia ranks in first place in 2013 with more than 59% of the global PV market.

- The market in Europe has decreased significantly from 22 GW in 2011 to 17 GW in 2012 and 10.3 GW in 2013. For the first time since 2003 Europe is no longer the top PV market in the world.

- The Asian markets experienced the highest growth (+170%) and China took first place (with an estimated 11.3 GW of grid connected PV systems), ahead of Japan (6.9 GW1) and the USA (4.75 GW). The first European country ranked fourth, with 3.3 GW installed is Germany.

- In the top 10 countries, 4 are Asia-Pacific countries (China, Japan, India, Australia)

“Asia ranks in first place in 2013 with more than 59% of the global PV market.”

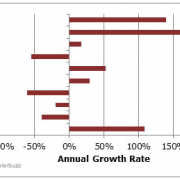

The top 10 global PV markets alone accounted for over 80% of end-market demand in 2013. Looking at last year’s growth rates of these countries in 2013, it shows a distinct trend that end-market demand is shifting away from Europe and towards Asia. In fact, the three fastest growing markets in 2013 were Japan, China, and Thailand, each more than doubling their end-market demand levels over the previous year. Conversely, three of the top European markets saw end-market levels decline in 2013, with only the United Kingdom showing growth.

Top 10 global PV markets of end-market demand in 2013 (Figure by NDP Solarbuzz – Marketbuzz 2014 report[2])

China has announced the installation of 11.3 GW of grid-connected PV in 2013. According to Chinese figures, the installations could have been even higher than that but some uncertainty remains on whether these additional PV systems have been connected to the grid or not. In any case, Chinese PV installations have set a new record in terms of new installations, above the 9.3 GW reported in Italy in 2011. This performance is in line with the ambitions of the Chinese authorities to continue developing the internal PV market, pushing for 35 GW by the year 2015 and 100 GW by 2020.

Japan was the second market for PV in 2013 with an estimated 6.9 GW of PV installations. While final numbers could slightly differ, this shows a dramatic increase in both countries compared to 2012.

In Asia, after the two market leaders, Thailand continued to grow, with 317 MW installed in 2013 and 704 MW of total capacity. Other markets continued to grow at a slower rate, such as Taiwan (170 MW), Malaysia for the second year of its feed-in tariff system (42 MW), as well as a few others.

Asia is undoubtedly the new focal market for PV.

![Top 10 global PV markets of end-market demand in 2013 (Figure by NDP Solarbuzz – Marketbuzz 2014 report[2])](https://brj.com.sg/wp-content/uploads/2015/04/graph-300x185.png)