77% of Southeast Asia’s Construction Businesses Committed to Integrating Data into Operations

Despite recognising the importance of data, more could be done to help construction businesses make strategic use of data

Procore Technologies, Inc., a global provider of construction management software recently released its annual construction industry benchmark report ‘How We Build Now: Technology Trends Shaping and Shifting Construction – Southeast Asia 2023’.

This year, the report surveyed construction decision-makers across Singapore, Malaysia, and the Philippines. The report reveals insights into the construction industry’s overall sentiment, current challenges and opportunities for businesses, how businesses are managing risks to protect their bottom line, and the level of digital maturity and adoption of construction technologies. The following types of construction businesses took part in the survey:

Gap in the confidence and ability to harness data in construction

According to Procore’s research, construction professionals are increasingly aware of the role of technology and data in their businesses but are still hesitant about their data strategy. Southeast Asia construction professionals who responded to the research unanimously agreed (99%) that better data management can bring benefits to their businesses. Respondents also estimated that on average, 22% of total project spend could be saved through more efficient data management.

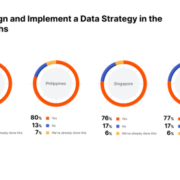

However, despite a high awareness of how data can be used to their advantage, only 6% of companies surveyed in Southeast Asia have laid the foundation for a data strategy. Additionally, although 77% are planning to design and implement a data strategy over the next 12 months, more than half of these companies (52%) are only somewhat confident in their ability to do so.

“It is clear from our research that while construction professionals in the region have a strong understanding that data and analytical insights can help drive better business outcomes and protect their businesses, many struggle with developing clear data strategies,” said Tom Karemacher, head of the region, Asia Pacific, Procore.

“While software vendors undoubtedly play a critical role in assisting construction businesses in this transformative journey, more can be done. Software vendors will need to clearly demonstrate the returns on investment, thereby justifying the indispensability of construction technology and data management. This will help drive the adoption of innovative solutions within construction that unlocks unparalleled value for the industry.”

Construction professionals continue to show interest in adopting technology

Despite the challenges in harnessing data, construction professionals in the region remain committed to embarking on their digital transformation journey. Respondents cited improved cost management (42%), reduced reliance on human labour (39%), resource efficiency through fewer errors or less rework (38%), improved build quality (38%), and improved ability to handle more projects (38%) as the benefits of technology adoption.

Correspondingly, more than three-quarters of businesses surveyed (77%) revealed that they are looking to increase their spending on construction technologies as a proportion of their annual budget. Interestingly, younger businesses that are aged below 10 years were found to be more likely to embrace technology (81%), as compared to established businesses over 10 to 20 years (71%) and those over 20 years (68%).

Of the technologies that will be the biggest drivers of change in the next three years, construction management platforms take the lead (55%), followed by payments technologies (38%), pre-fabrication (34%), big data (33%), and next-generation BIM (30%).

Optimism across the Southeast Asia Construction Industry

Overall, there is optimism among the construction industry professionals surveyed. Industry confidence for Singapore this year stands at 90% confident, where 50% were very confident, and 40% were somewhat confident. In 2022, we received a 93% confidence rate where 45% were very confident, 48% were somewhat confident).

When polled on the construction industry outlook in Southeast Asia, 88% of respondents expressed confidence in the industry’s market conditions over the next 12 months. Driving this optimism was expectations for the increase in both the number (73%) and value of projects (71%) over the same period.

Respondents are also placing a larger emphasis on risk management to protect their bottom line. Almost four in 10 respondents (39%) are rethinking contracting models to protect margins or considering new payment methods, such as early payments at reduced margins (37%). A focus on risk management has become more important, especially in light of persistent challenges such as the increased cost of raw materials and equipment (44%) and winning competitive bids and tenders at a sustainable margin (32%), as revealed by respondents.

“The How We Build Now report was developed as a research tool to reflect on the issues impacting the industry at a moment in time. Through this report, we hope to inspire new conversations and share how construction leaders are bridging the gap between challenges and solutions,” concluded Karemacher. Additional highlights from the report include:

- Wait-and-see approach to technology adoption: 40% of respondents reported that they prefer to wait until technologies are more established and proven before adopting them.

- Time spent on rework: On average, 1 in 5 project hours remain wasted on rework, hindering productivity where time could be spent more efficiently.

- Workplace diversity and inclusion in construction needs to improve: Currently, women make up a minority of the construction workforce, particularly in executive (25%), site manager (24%) and team leader (27%) roles.

- More emphasis on sustainability is needed: Only 51% of respondents believe that the construction industry needs to do more to adopt more environmentally friendly and sustainable building practices.